A decision is made when a decision-making agent receives inputs and returns outputs to the environment external to it. A decision-making agent can be either human being or a machine e.g. computer. We need three main elements in order to make good decisions:

|

| Data-information-knowledge model |

Data are syntactic entities. They are patterns with no meaning; an input to an interpretation process, i.e. the initial step of decision making.

Information is interpreted data, data with meaning. It is the output from data interpretation as well as the input to and output from the knowledge-based process of decision making.

Knowledge is learned information. It is the information incorporated in the decision-making agent's reasoning resources and made ready for active use within a decision process. It is the output of a learning process.

As I used to work with as an Auditor few years ago, I will use an example of auditing financial statements to show how auditors use data, information and knowledge to form an opinion about the financial statements.

The

auditors use data and information provided to them by the management,

together with their skills, knowledge and experience to form an opinion

about the financial statements. The

auditor expresses an opinion indicating reasonable assurance that the

financial statements are free from material misstatement and that they

are fairly presented. The opinion

formed is considered as the auditor's decision and its of great

importance as key stakeholders e.g. financiers, shareholders etc. of

the company use it to make key decisions.

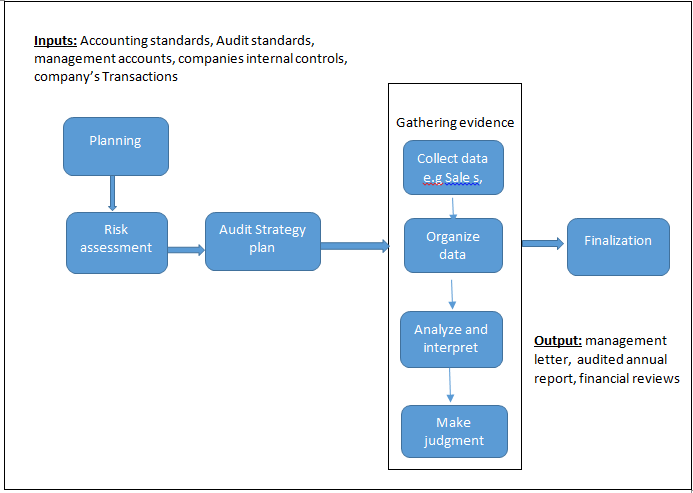

The auditor use the process shown below:-

Planning:- The auditor plans receives formal acceptance of the client, plans the audit by allocating teams, nature and timing of audit work and verifys independence requirements. The challenge here is that the planning depends on the information given by the management to the auditor which may not be conclusive or transferred correctly.

Risk assessment:- The auditor then assesses the risks that could lead to material misstatement in the financial statements. The challenge here is that the auditor uses their knowledge and often involves a high degree of judgement and requires significant level of experience by the auditor.

Audit Strategy Plan:- The auditor develops an audit strategy to address the risks identified. This involves designing a testing approach, deciding whether and how to rely on the company's internal controls, developing a detailed time table and allocating tasks to audit teams. The challenge here is on the allocation of tasks to team members as the auditor need to know and understand their strengths and weaknesses, what they can do best!

Gathering of evidence:- The auditor gathers evidence used to form the opinion through testing and tracing transactions of the company as well as obtaining third party documentations. The challenge here is that the auditor has to apply professional scepticism and judgement when gathering and evaluating evidence.

Finalization:- This is the last phase of audit where the auditor forms the overall conclusion based on the tests they have carried out, the evidence they have obtained and the other work they have done. There is a challenge here of forming the wrong opinion if the auditor don't have enough knowledge, the data and information given is not conclusive or enough or if there was misunderstanding between the auditor and the management when the information was being transferred.

Other challenges/ problems are:-

- The decision formed is based on the information given by the management to the auditor, which maybe distorted.

- What constitutes sufficient appropriate evidence is a matter of professional judgement.

- Auditors has to use their skills, knowledge and experience to form an opinion

- Financial statements are prepared on a going concern assumption that the company will be in operation for at-least the next 12 months. The assumption is made by the auditor using his knowledge, data and information provided.

- The auditor can not obtain absolute assurance that financial statements are free from material misstatement.

- The auditor uses selective testing in gathering information and some critical information/transaction maybe missed.

- It is difficult to detect fraud since it is intentionally hidden and may involve collusion by multiple participants.

References

PWC: Understanding financial statements audit. January 2013 . www.pwc.com

http://www.idi.ntnu.no/~agnar/publications/dke-95.pdf

http://www.idi.ntnu.no/~agnar/publications/dke-95.pdf

This comment has been removed by the author.

ReplyDeleteHi Teresiah

ReplyDeleteThanks for this blog I found it interesting to learn how much personal judgment and gut feel, albeit a knowledgeable one, goes into these audits. Looking at the information here it looks like it would be a good contender for an intelligent system that could help with making these decision similar and require less of a human factor.

I thought you might be able to indicate on the image where the problem areas were in regards to data collection and reporting and if there are points where fraud detection systems could be utilised.

I really liked the layout and felt it separated the points and clearly defined the areas very well.

Sorry Teresiah, I thought this had duplicated so I removed it and it removed both so I had to put it back again. luckily i had a copy in Word.

ReplyDeleteHi Russell,

ReplyDeleteThanks for the comment.

The image became quite messy while trying o put the problems, and decided to put them in explanations. The following techniques, among others, can be used to detect fraud:-

1. Data mining to classify, cluster, and segment the data and automatically find associations and rules in the data that may signify interesting patterns, including those related to fraud.

2. Expert systems to encode expertise for detecting fraud in the form of rules

3. Pattern recognition to detect approximate classes, clusters, or patterns of suspicious behaviour either automatically (unsupervised) or to match given inputs

4. Machine learning techniques to automatically identify characteristics of fraud

5. Neural networks that can learn suspicious patterns from samples and used later to detect them

Hi Teresiah,

ReplyDeleteInteresting insight about how auditors operate. The step that I suggest you clarify or explain more on is the finalization process, you have outlined the challenge faced by the auditor forming a wrong opinion if they have wrong knowledge which can be attributed to bad data. Is there a way that you think this can be avoided or at least improved?

Thanks

Makali

Thanks Makali,

ReplyDeleteThe most work lies in the collection of evidence which is the basis of forming the opinion. But the big decision lies in the finalization process where the auditor combines all the decisions made from commencement to finalization of the audit to decide whether in his opinion he/she believes the financial statements are true and fair and are free from misstatements. One way to avoid forming the wrong opinion is by ensuring the auditor has enough experience, knowledge and skills to make the right decisions. There also need to be enough time so that if the auditor feels he/she needs more information, he/she can always go back to the previous steps. Also, the auditor can use technology to collect, classify and analyse data and information received to aid in decision making.

Thanks.

This comment has been removed by the author.

ReplyDeleteThanks Steve,

ReplyDeleteYeah the auditor looks for information everywhere about the company. They check the supporting documents from third parties as well. Like banks, suppliers etc. They also check other reports other than the financials like minutes of all meetings etc. They also check for publications about the organization e.g. in newspapers etc. Its an extensive work!

Steve, you have removed your comments..😢😢

ReplyDelete